Loan Reviews

Vital Function for Community Banks May Be Outsourced if Care is Taken

CEIS Review

www.ceisreview.com

info@ceisreview.com

888-967-7380

75 Broad Street,

Suite# 820

New York, NY 10004

3191 Coral Way

Suite 201

Miami, Florida, 33145

305-442-6088

8 Tannery Lane

Camden, Maine 04843

207-230-2515

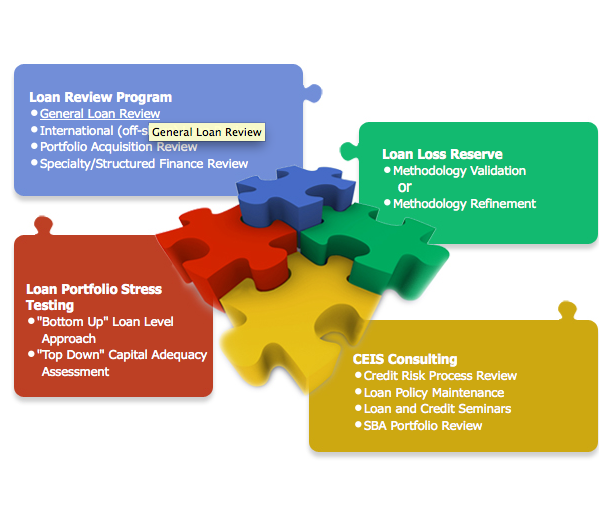

CEIS Review CEIS Review is an independently owned consulting firm serving the needs of the commercial and savings bank communities as well as those of other commercial lending institutions. Our services include loan review, loan loss reserve methodology and validation, CRE portfolio stress testing, portfolio acquisition review, CRE concentration analysis, credit risk management process review, structured finance review, credit loan policy maintenance, problem loan advisory, credit analysis, regulatory relations, credit database formation, and loan and credit seminars.

The loan review function is a tool that monitors the quality of the respective institution’s loan portfolio as it relates to internal lending policies, the effectiveness of the credit administration function, and is thus a tool to be utilized by senior management and the board. The loan portfolio is typically the asset that presents the greatest potential risk for loss exposure to banks. The board of directors of each financial institution has the legal responsibility to formulate appropriate lending policies and to supervise ongoing implementation thereon. Although smaller institutions are not expected to maintain separate loan review departments, it is essential that an effective loan review system be in place at all regulated financial institutions.

CEIS Profile

- Clients with portfolios based throughout North and South America

- Experience with Federal and State chartered banks and credit unions, public and private

- Risk Review Professionals each with minimum of 20 to 25 years banking experience

- Portfolio Review practice with more than 50 professionals

- Risk Review Programs providing continuity in service and appropriate rotation

- Suite of services addressing multiple portfolio concerns

CEIS Benefits to Clients

- Opinions independent of organizational politics or related influences

- Services customized to your continuing or surge requirements

- Highly experienced professionals available on an as needed basis

- Resource providing observations regarding industry credit trends

- Credibility of proven and reputable credit risk assessment company

- Objectivity in reports to the Audit Committee and other interested parties

- Improved identification and management of credit risk issues

- Enhanced credit risk management infrastructure

- Contain costs, while improving credit review resources